Is definitely the global bond market inside of a bubble?

Share

Wall Street shills are in near perfect agreement how the bond marketplace is not inside of a bubble. And, even when usually there are some around the fringes who will admit you exists, they say it can burst harmlessly considering that the Fed is simply gradually letting the oxygen out of inside. However, the reality that were in a bond bubble is beyond a doubtand in the magnitude of your yield distortions that are out there today, the issues of the unwinding will likely be epoch.

Due to your risks linked to inflation and solvency concerns, it must be a prima facie case that sovereign bond yields dont want to venture anywhere near zero percentand in some instances, shockingly, below zero percent. Even when a nation would come with an annual budget surplus without inflation, it has to still provide investors which includes a real, after-tax return on government debt. In the context of today’s inflation-seeking and debt-disabled governments, negative nominal rates are equivalent to investment heresy.

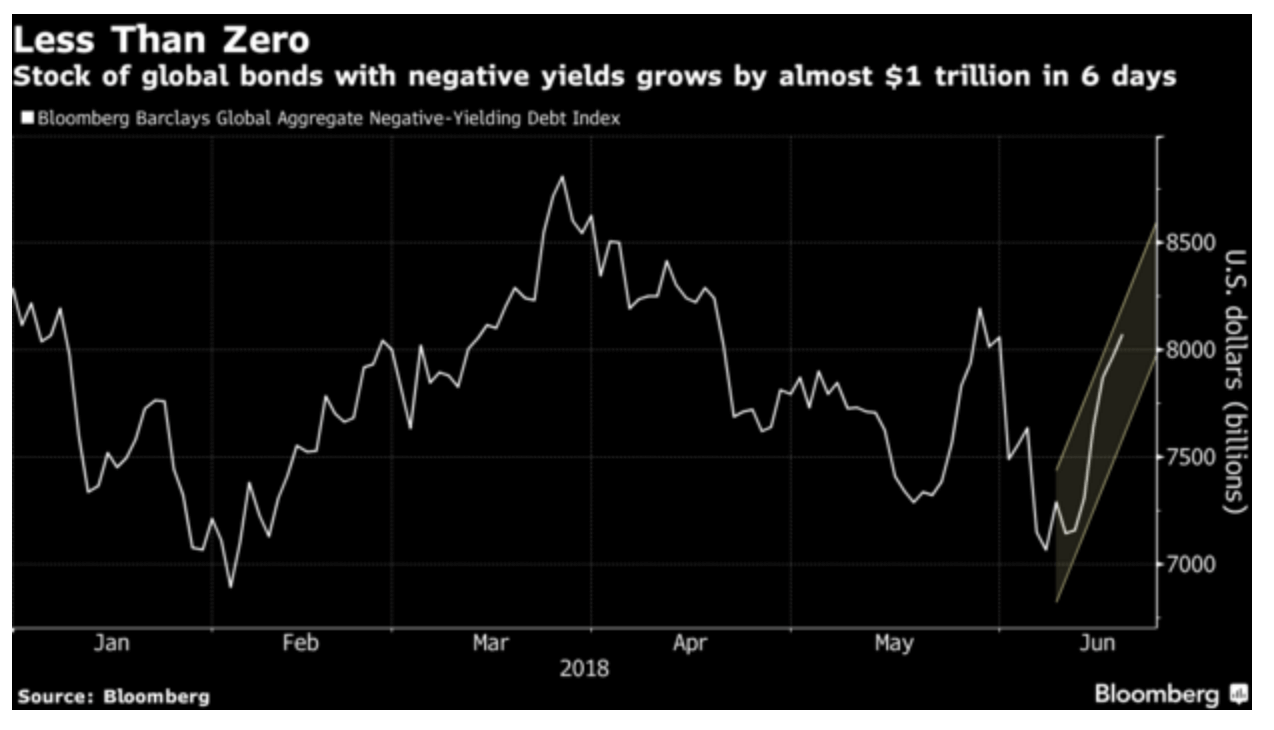

At its peak in 2016, there is a total of over $14 trillion worth of global sovereign bonds having a negative yieldmostly in European and Japanese debt. Although that total has decreased recently, it really is above $8 trillion.

? Michael Pento

And although U.S. Ten-year Treasury note yield has never been negative in nominal terms, it really is clearly inside sub-basement of history.

? Michael Pento

Given these facts, any free-thinking individual must assent that the global bond market is in a very bubble. It may be definitely worse overseas, though the U.S. bond market still is prone to the identical contagion. Given our trillion-dollar annual deficits, a national debt that may be $21.5 trillion (105 percent of GDP), and consumer price inflation which is throughout the Fed’s 2 percent target, the abnormality in U.S. rates is completely absurd.

The factor to this complete discussion about bonds being extraordinarily overvalued is definitely the arrival of inflation on to the scene, that’s absent for a decade while in the eyes on the consumer since it was mostly sequestered within stock, bond and real estate prices.

But because of central banks’ inflation “successes,” combined with additional $70 trillion in debt levels worldwide because Great Recession, mortgage rates have did start to rise. It has compelled many central banks to shift strategies from the quest for inflation, to at least one of inflation containment.

Importantly, this transformation from central banks is not a voluntary decision, unlike exactly what the Wall Street carnival barkers maybe have you believe. Put simply, rates are not rising for all your right reasons. But instead, they are really rising as a consequence of runaway asset prices, surging debt levels plus the resurgence of rising consumer prices. Therefore, these money printers don’t have any choice but to retreat of their inflation quest, or they now risk an instant and destructive development of long-term bond yields.

Hence, global central banks looking to stick the inflation landing by hoping CPI stays on the 2 percent level and praying interest rates nestle in to a tight trading range that remains completely harmless to this over leveraged economy.

However, this is often diametrically opposed to the really nature and construction of asset bubbles. Look at the last two types of the NASDAQ crash in 2000 as well as Properties debacle in 2008. These asset bubblesjust just like all the rest in history–needed a consistent method to obtain new monetary fuel to live inflated. The Fed inverted the yield curve shortly before each crash and take off banks’ profit motive to lend. Additionally, nevertheless these assets became so inflated relative to incomes and the underlying economy that investors weren’t any longer competent at throwing new money their way.

Once stock and home prices started to rollover, there was a panicked rush with the exits. That is primarily mainly because of the massive leverage a part of these bubbles. Owning assets on margin is actually excessive debt is too expensive and just is practical in the raging bull market. As soon as the tide turns, the offers start to gather quickly and exacerbate the move reduced prices.

The bigger the distortion of asset prices the greater the reset will likely be. And the warping of interest rates due to global central banks has never been anywhere near this extraordinary. What Mr. Powell, plus the rest of the central bank leaders fail to grasp, is always that asset bubbles contain tremendous potential energy and tend to be virtually impossible to rest innocuously.

The Fed is hoping to engineer a gentle landing with the bond bubble it created, but no such condition are at all probable. Should the Fed Funds Rate (FFR) has been in close proximity to its mean close to 6.Five percent, you should then perhaps going to a possible chance. However, in the current FFR of just 2.25 percent, it can be far beneath the average and nowhere at the so-called equilibrium rate–where its neither a stimulant or depressant for that economyespecially in light of the reality that no such condition useful rate nirvana can be available from a central bank.

Therefore, herein lies the rub: should the Fed were to stop raising the FFR within the current level, there’s a simple significant risk that long-term interest levels would explode higher within the back of surging debt levels and rising inflation. That might cause debt service payments to skyrocket and bring about mass insolvencies for consumers and corporations; equally as it put extreme fiscal pressure on all variety of government. And, when the Fed were to keep on its path towards interest rates and balance sheet normalization, short-term rates will rise, as well as credit-fuel supporting asset bubbles are certain to get slammed shut. Thus, forcing the economy in a steep recession/depression from where there’ll be no easy escape.

History conclusively dictates that asset bubbles never correct with impunity; they leave a wake of carnage behind them corresponding to the extent with the previous imbalances. The international and unprecedented bond bubble will surely stop being the exception to the empirical fact.